-

- News

- Books

Featured Books

- pcb007 Magazine

Latest Issues

Current Issue

The Essential Guide to Surface Finishes

We go back to basics this month with a recount of a little history, and look forward to addressing the many challenges that high density, high frequency, adhesion, SI, and corrosion concerns for harsh environments bring to the fore. We compare and contrast surface finishes by type and application, take a hard look at the many iterations of gold plating, and address palladium as a surface finish.

It's Show Time!

In this month’s issue of PCB007 Magazine we reimagine the possibilities featuring stories all about IPC APEX EXPO 2025—covering what to look forward to, and what you don’t want to miss.

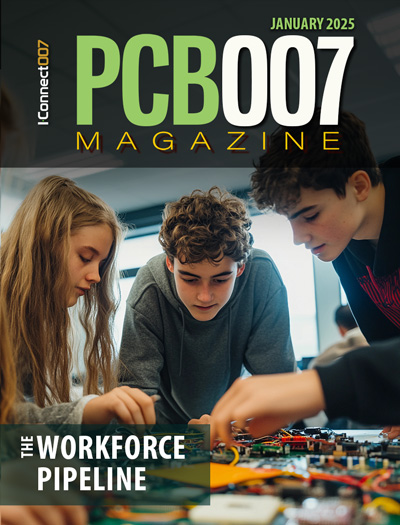

Fueling the Workforce Pipeline

We take a hard look at fueling the workforce pipeline, specifically at the early introduction of manufacturing concepts and business to young people in this issue of PCB007 Magazine.

- Articles

- Columns

Search Console

- Links

- Media kit

||| MENU - pcb007 Magazine

Mapping the Future PCB Industry Landscape: An Interview with Phil Plonski

September 13, 2000 |Estimated reading time: 4 minutes

Mapping the Future

PCB Industry Landscape

J.

Philip Plonski will deliver an address on market trends on Wednesday,

October 4th, at EPC 2000 in Maastricht, The Netherlands. Plonski is Senior

Consultant at Prismark USA, a consulting service to the electronics industry.

Mapping the Future

PCB Industry Landscape

J.

Philip Plonski will deliver an address on market trends on Wednesday,

October 4th, at EPC 2000 in Maastricht, The Netherlands. Plonski is Senior

Consultant at Prismark USA, a consulting service to the electronics industry.

In recent years, Asian PCB fabricators have more than doubled their market share of the global PCB industry. Plonski will address such issues as pricing, profitability, technology transfer, product variations, increased local Asian assembly, electronic trading and other factors that may accelerate the trends of the last decade and redraw the PCB industry landscape during the next decade.

Plonski gave www.pcb007.com a preview of some of the issues he will address at EPC - European PCB Convention - as well as general market topics. Following are his answers to questions we posed.

PCB007: JVC said recently that it is doubling its orders placed with Taiwan component suppliers over last year. Viasystems Group said last May that it planned to send its low-cost PCB production to its China plants. Japan is ranked first in the world in both rigid and flexible circuit production; Taiwan takes third place in both. The stories and statistics go on, signifying a trend toward an increasing Asian market share. Will your EPC address hold encouraging news for US and European PCB makers who may feel as though contracts (and potential contracts) are slipping out of their grasp?

Plonski : The expected worldwide growth in printed circuit markets is exciting and encouraging for those companies who can globalize their influence and scope. US and European PCB makers can take advantage of their strong relationships with OEM system designers and must form new ones with Contract Manufacturers to capitalize on optimum regional production costs.

PCB007: China is considered a major consumer market for the electronics industry. How will this affect Asian PCB fabrication in the next 10 years? What about US and European PCB makers?

Plonski: China is developing a strong infrastructure to support its local markets. Printed circuit production is just one of many industries supporting the electronics markets inside China. Investment for printed circuit fabrication in China by outside corporations has been heavy. Taiwanese, Japanese, American and European corporations have all committed this way.

Over the coming 10 years, the global management of printed circuit production will become more routine, and China will be only one of several pieces of the pie. Fabrication in Asian regions in general will continue to grow faster than what we see in Europe and the US.

PCB007: One area of growth is information technology. Global IT spending is expected to explode over the next five years, from a projected US$1.4 trillion this year to over $2 trillion in 2003, according to a recent report from SPS/Spectrum Economics. By 2005, worldwide spending for IT products and services is expected to reach $2.6 trillion. It will take a lot of PCBs to drive the computers used in IT. Who is positioning to capture the market and make those boards in the next five years?

Plonski: The applications for printed circuits in IT are very broad; spanning simple boards in consumer products such as "WEB-TV" through complex opto-electronic high-speed backplanes for telecom switches. Many companies are well positioned to take advantage of some of the pieces.

Those companies who recognize that shorter design life cycles and highly adaptable services are expected, and can survive in this atmosphere, will capture their respective markets. It will take more investment, and bold strategies by current fabricators.

PCB007: At EPC you will address electronic trading. Would you elaborate on that topic? What do you view as the pros and cons of electronic trading?

Plonski: Although electronic trading has promised a lot in improving overall efficiency of markets through better information (i.e., instant pricing comparisons, schedule and capacity planning), there is a lot remaining to do. The fastest growing segments of the printed circuit markets are technology driven and quite customized. Reducing complex emerging printed circuit products such as microvia multilayers and organic IC substrates to "commodity buys" through electronic trading will not be an easy task.

PCB007: Parts shortages! How are they redrawing the PCB industry landscape right now? Next year? In two years?

Plonski: If electronic systems are incomplete waiting for the simplest of parts, they don't ship. Parts shortages exist but are transient and often unpredictable; like consumer demand. They make production scheduling of PCBs more difficult because assemblers push inventory management back up the supply chain. WIP management at the printed circuit fabricator is essential to survival. This won't change over the next few years.

Prismark is a consulting company serving the electronics industry. Prismark's expertise is focused in five main areas: Acquisitions And Investment In New Technologies; Analysis of Business Opportunities in Emerging Markets; Choice of Packaging, Interconnect, Assembly and Test Technologies for Designers of Advanced Systems; Assessment of Global Manufacturing Competitiveness; and Benchmark, Pricing and Forecasting Demand for Materials Components And Equipment

Prismark is on the Web at www.prismark.com.