-

- News

- Books

Featured Books

- pcb007 Magazine

Latest Issues

Current Issue

The Essential Guide to Surface Finishes

We go back to basics this month with a recount of a little history, and look forward to addressing the many challenges that high density, high frequency, adhesion, SI, and corrosion concerns for harsh environments bring to the fore. We compare and contrast surface finishes by type and application, take a hard look at the many iterations of gold plating, and address palladium as a surface finish.

It's Show Time!

In this month’s issue of PCB007 Magazine we reimagine the possibilities featuring stories all about IPC APEX EXPO 2025—covering what to look forward to, and what you don’t want to miss.

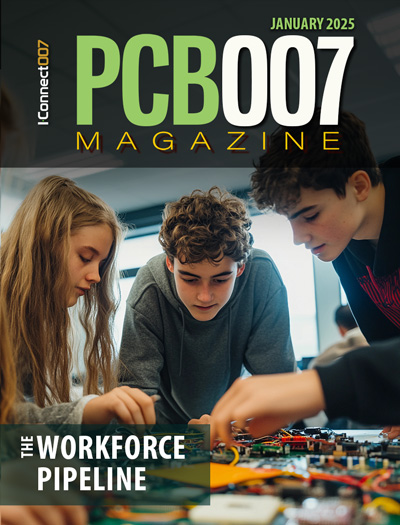

Fueling the Workforce Pipeline

We take a hard look at fueling the workforce pipeline, specifically at the early introduction of manufacturing concepts and business to young people in this issue of PCB007 Magazine.

- Articles

- Columns

Search Console

- Links

- Media kit

||| MENU - pcb007 Magazine

Sluggish Telecom Market Growth Prompts Operators to Become Full-Stack Technology Suppliers

November 18, 2024 | IDCEstimated reading time: 3 minutes

Worldwide spending on telecommunications and pay TV services will reach $1,544 billion in 2024, representing an increase of 2.4% year-on-year, according to the Worldwide Semiannual Telecom Services Tracker published by International Data Corporation (IDC). The latest prediction is 1.0 percentage points higher than the version published in the May edition of IDC's Tracker. If that forecast becomes reality, the above-mentioned annual growth rate would be the highest recorded in the last twelve years.

The above-average positive revisions of the forecast apply to the regions of the Middle East and Africa (MEA) and Latin America. This is mainly a consequence of hyperinflation in countries such as Turkey, Egypt, Nigeria, and Argentina, in which it has become usual to see average revenue per user (ARPU) figures growing by more than 50% on a yearly basis. Conversely, our outlook for the markets of Europe and Asia Pacific has been slightly downgraded, mainly due to the deteriorating economic climate in key countries such as Germany and China. The expectations for the North America have not changed much between the two tracker updates, apart from a minor positive revision in Canada's market.

The analysis by type of telecom services confirms that the well-known trends persist despite the changes in top-line forecasts. Mobile remains the largest segment, driven by the growth in mobile data usage and M2M applications, which is offsetting declines in spending on mobile voice and messaging services. The fixed data services segment will continue growing, driven by the need for higher bandwidth. Spending on fixed voice services will be dropping over the forecast period as the rapidly declining TDM voice revenues are not being offset by the increase in IP voice. The traditional pay TV market will decline slightly over the forecast period due to the growing popularity of VoD and OTT, but these services will remain an important part of the multi-play offerings of telecom providers across the world.

The global connectivity services market is expected to maintain a positive outlook over the next five years, with a compound annual growth rate (CAGR) of 2.0%. The overall economic climate is expected to improve as the key central banks in the U.S. and Europe will continue decreasing their reference interest rates. Inflation will continue declining, which will have a positive impact on the purchasing power of the population. The negative elements of the forecasting puzzle will include saturation of the telecom services markets in major countries, as well as the unstable political situation in some regions, particularly Eastern Europe and the Middle East. Additional risks are related to the potential shifts of economic policies related to the new U.S. government that might lead to the rebirth of protectionism.

Our latest forecast is clearly more optimistic than the previous one. However, even in this scenario, the growth of the connectivity services market is expected to remain sluggish, prompting operators to seek additional revenue streams. "There are quite a few promising areas in which operators could expect solid returns. These include fiber optics, IoT, UCaaS, SD-WAN, digital services, LEO satellite services, cloud services, IT security services, network APIs and network sharing, and 5G-advanced," says Kresimir Alic, research director with Worldwide Telecom Services at IDC. These companies should also increase the pace of digitalization and software-ization of their business processes, create new go-to-market strategies based on data and intelligence, and deploy innovative business models based on telco-as-a-platform and co-creation within ecosystems. "Essentially, telecom operators should aim for a complete transformation - from traditional commodity service providers to modern, full-stack technology suppliers. This transformation should position them as leaders in the digital transformation revolution, potentially securing a central role in the new digitalized world."

Suggested Items

New Accenture Siemens Business Group to Reinvent Engineering and Manufacturing for Clients

03/31/2025 | BUSINESS WIRESiemens and Accenture are significantly advancing their long-standing alliance partnership to help clients reinvent and transform engineering and manufacturing.

Datest to Highlight Flying Probe Programming and X-ray Testing Services at Upcoming SMTA Texas Expos

03/25/2025 | DatestDatest, a leading provider of integrated PCBA testing, imaging, inspection, and failure analysis services for the electronics industry, is excited to announce it will exhibit in the upcoming SMTA Dallas Expo on Tuesday, April 1st, and the SMTA Houston Expo on Thursday, April 3rd, 2025.

Cadence Joins Intel Foundry Accelerator Design Services Alliance

03/17/2025 | Cadence Design SystemsCadence is expanding its collaboration with Intel Foundry by officially joining the Intel Foundry Accelerator Design Services Alliance! This collaboration amplifies both companies' efforts to drive innovation, support advanced chip design, and solidify Intel Foundry as a leader in cutting-edge semiconductor solutions.

Sartorius Lab Instruments GmbH & Co. KG, First German EMS Company to Receive IPC J-STD-001 and IPC-A-610 Qualified Manufacturers Listing

03/10/2025 | IPCIPC's Validation Services Program has awarded an IPC J-STD-001 and IPC-A-610 Qualified Manufacturers Listing (QML) to Sartorius Lab Instruments GmbH & Co. KG. Sartorius is a leading international provider to the biopharmaceutical research and medical industry.

Saab Enhances Airport Operations with Digital Apron Management Center at Lima Airport

03/10/2025 | SaabSaab has equipped Lima Airport’s Digital Apron Management Center with advanced technologies to enhance operational efficiency and capacity.