-

- News

- Books

Featured Books

- pcb007 Magazine

Latest Issues

Current Issue

The Essential Guide to Surface Finishes

We go back to basics this month with a recount of a little history, and look forward to addressing the many challenges that high density, high frequency, adhesion, SI, and corrosion concerns for harsh environments bring to the fore. We compare and contrast surface finishes by type and application, take a hard look at the many iterations of gold plating, and address palladium as a surface finish.

It's Show Time!

In this month’s issue of PCB007 Magazine we reimagine the possibilities featuring stories all about IPC APEX EXPO 2025—covering what to look forward to, and what you don’t want to miss.

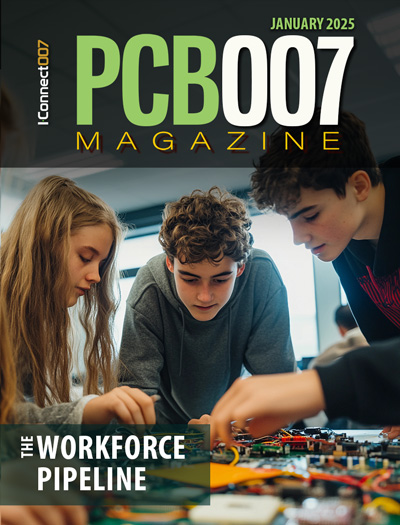

Fueling the Workforce Pipeline

We take a hard look at fueling the workforce pipeline, specifically at the early introduction of manufacturing concepts and business to young people in this issue of PCB007 Magazine.

- Articles

- Columns

Search Console

- Links

- Media kit

||| MENU - pcb007 Magazine

European and Japanese IDMs Strengthen Collaboration with Chinese Foundries to Capture ‘China for China’ Opportunities

January 9, 2025 | TrendForceEstimated reading time: 1 minute

TrendForce’s latest investigations reveal that geopolitical dynamics are accelerating the formation of the “China for China” supply chain, driven by China’s vast domestic market. This trend is particularly evident in the automotive sector.

The Chinese government has set a goal for domestic automakers to increase the use of locally produced chips to 25% by 2025 while also encouraging foreign companies to localize their production. In response, major automotive chip suppliers such as STMicroelectronics, Infineon, NXP, and Renesas have been exploring partnerships with Chinese foundries—including SMIC and HHGrace—aiming to accelerate diverse platform development.

Historically, Chinese foundries have faced challenges securing automotive MCU outsourcing orders from IDMs due to slower progress in eFlash/eNVM manufacturing processes and the lengthy automotive-grade and OEM verification processes required.

However, recent geopolitical pressures, along with the launch of affordable EV models in China, have driven automotive suppliers to prioritize cost-efficient solutions. This cost focus—combined with the “China for China” strategy—has led to a more proactive space for European and Japanese IDMs to collaborate with these foundries.

TrendForce reports that STMicroelectronics has taken the lead by partnering with HHGrace to develop 40nm industrial/automotive-grade MCUs. Mass production is expected by late 2025 if development progresses smoothly. Meanwhile, Renesas and Infineon began discussions with Chinese foundries in 2024 for contract manufacturing partnerships. NXP recently announced plans to establish a supply chain in China. While there are no immediate plans for setting up a local manufacturing plant, discussions with Chinese foundries for contract production are ongoing.

For overseas foundries with operations in China, the ability to assist customers in transitioning products across platforms and manufacturing facilities to meet localization requirements presents both opportunities and significant challenges. Price competition with domestic Chinese foundries remains intense, adding pressure to sustain profitability.

TrendForce emphasizes that while IDMs and Chinese foundries are building partnerships in automotive and industrial control chip sectors, these products must undergo rigorous validation standards and OEM certifications that far exceed those required for consumer applications.

TrendForce forecasts that IDM-manufactured products under the “China for China” strategy are expected to enter mass production in the second half of 2025, contributing to revenue growth. The impact of these collaborations is projected to expand further by 2026, solidifying the role of these partnerships in the evolving semiconductor landscape.

Suggested Items

CEE PCB Appoints Markus Voeltz to Business Development Director Europe

04/02/2025 | CEE PCBCEE PCB, a leading manufacturer of printed circuit boards (PCBs) and flexible printed circuits (FPCs) with 3 production facilities in China, is expanding its presence in Europe and began providing local support in March 2025. With 25 years of experience in the industry, the company is enhancing its commitment to European customers by providing more direct collaboration for technical inquiries and advice.

Winners of 2025 IPC Masters Competition China Announced

04/02/2025 | IPCOn March 26-28, the IPC Masters Competition China was successfully held in Pudong, Shanghai. This year’s competition brought nearly 500 electronics industry elites from 18 provinces and municipalities.

China to Invest 1 Trillion Yuan in Robotics and High-Tech Industries

03/25/2025 | IFRChina’s National Development and Reform Commission has announced to set up a state-backed venture capital fund focused on robotics, AI and cutting-edge innovation.

Hitachi Energy Gains National Green Factory Recognition for Two More Facilities in China

03/24/2025 | Hitachi EnergyChina’s Ministry of Industry and Information Technology (MIIT) recently announced its 2024 Green Manufacturing List, with two of Hitachi Energy's local manufacturing bases in Beijing and Datong in north China’s Shanxi Province, receiving the titles of National Green Factory. This brings the total number of Hitachi Energy's local enterprises on the list to four.

Vexos Enhances Global Manufacturing Footprint with New Electronics Manufacturing Facility in China

03/13/2025 | EINPresswire.comVexos, a leading global provider of Electronic Manufacturing Services (EMS) and Custom Material Solutions (CMS), is pleased to announce the successful relocation of its China operations to a newly opened, state-of-the-art manufacturing facility in Dongguan, China.